Domestic electricity consumption was up 3.6% y/y in February 2016. The growth was concentrated in the greater Tbilisi area, with a 14.3% y/y increase in Telasi consumption (38.8% of total DNO consumption), while consumption in the regions (Energo-Pro, 56.8% of total DNO consumption) was up only 0.6% y/y. Consumption by eligible consumers is still decreasing (-13.8% y/y in February 2016), but at a significantly lower rate than in the previous months. Its share in total consumption is down from 12.3% in February 2015 to 10.2% in February 2016. Georgian Manganese remains the key driver of the decrease, with its consumption down 16.2% y/y in February 2016. Another factor was the Rustavi Water Company (RWC), which is no longer registered as an eligible consumer and is now serviced by Energo-Pro Georgia. It is worth noting that RWC only accounted for less than 3% of consumption by eligible consumers. The Abkhazian region faced an electricity deficit in February (expected to continue in March), due to low water levels in Enguri and Vardnili HPPs, the region’s sole electricity sources. The Ministry of Energy implemented a short-term solution by negotiating a deal with Russian suppliers for additional capacity (29.2gWh). However, with ever-growing electricity demand in the Abkhazian region, a longer-term solution is needed, as underlined by the Minister of Energy.

In February 2016, domestic generation decreased 4.0% y/y on the back of reduced TPP output. The amount of TPP-generated electricity decreased 21.3% y/y, due to a 93.6% y/y decrease in electricity generated by Tbilsresi. Tbilsresi accounted for only 4.3% of total TPP output in February 2016, while that figure was 53.2% in February 2015. This drop was partially offset by the newly commissioned Gardabani TPP, which accounted for 40.4% of total TPP output in February 2016. Consequently, the share of imported electricity increased in the total electricity supplied to the grid, with imports almost doubling (+91.8% y/y) in comparison to February 2015. The drastic increase was partly due to a one-off event – importing additional electricity from Russia to fill the deficit in the Abkhazian region. Output of the regulatory HPPs, Enguri and Vardnili, was down 8.9% y/y due to low precipitation. Generation by other HPPs was up, resulting in an increased share in domestic generation.

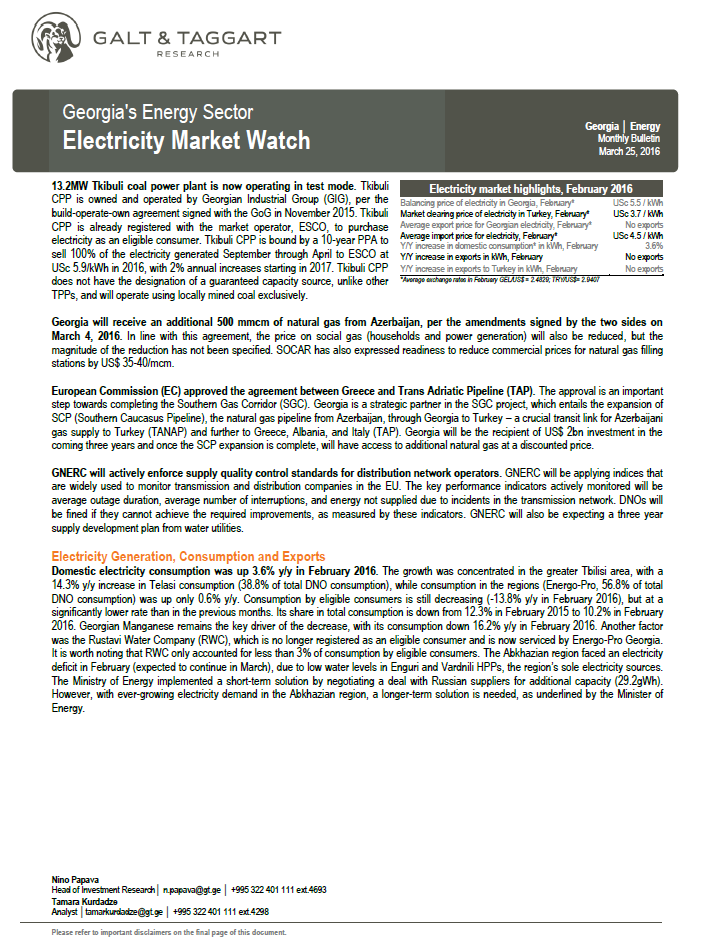

The balancing electricity price in Georgia was down 25.3% y/y to USc 5.5/kWh. The market clearing price of electricity in Turkey was down 37.3% y/y to USc 3.7/kWh. Since the balancing electricity price in Georgia is the weighted average price of electricity traded by ESCO, it is important to note that in February 2016, only 7.5% of locally generated electricity was sold through ESCO; the rest was traded through bilateral contracts. Furthermore, 60.9% of ESCO-traded electricity in February 2016 was imported, so the balancing electricity price largely reflected the price of imported electricity. Average import price of electricity was down 31.7% y/y to USc 4.5/kWh, as compared to over USc 6/kWh in previous years. The relatively low price of imported electricity was due to the significantly discounted Russian electricity that Georgia imported to fill the deficit in the Abkhazian region. 92.0% of total imported electricity came from Russia and the rest from Azerbaijan. There were no electricity exports in February 2016.

According to preliminary figures, net FDI inflows in the energy sector made up US$ 89.9mn, or 6.7% of total FDI inflows in 2015. A significant recipient of FDI was the Shuakhevi HPP in the Adjara region, which is being constructed by Clean Energy (Norway) and Tata Power (India). Along with Adjaristsqali Georgia (the joint venture building Shuakhevi HPP), Nenskra Hydro also landed among the top 10 recipients of FDI in 2015. While there was a 52.7% y/y drop in net FDI to the energy sector, investor interest in the hydro sector remains high. As of February 2016, 26 HPP projects, with total installed capacity of 1,869MW, are in the construction or licensing stages (estimated investment cost of US$ 3.2bn), while an additional 25 HPP projects (1,075MW total installed capacity) are in the feasibility study stage with construction rights.