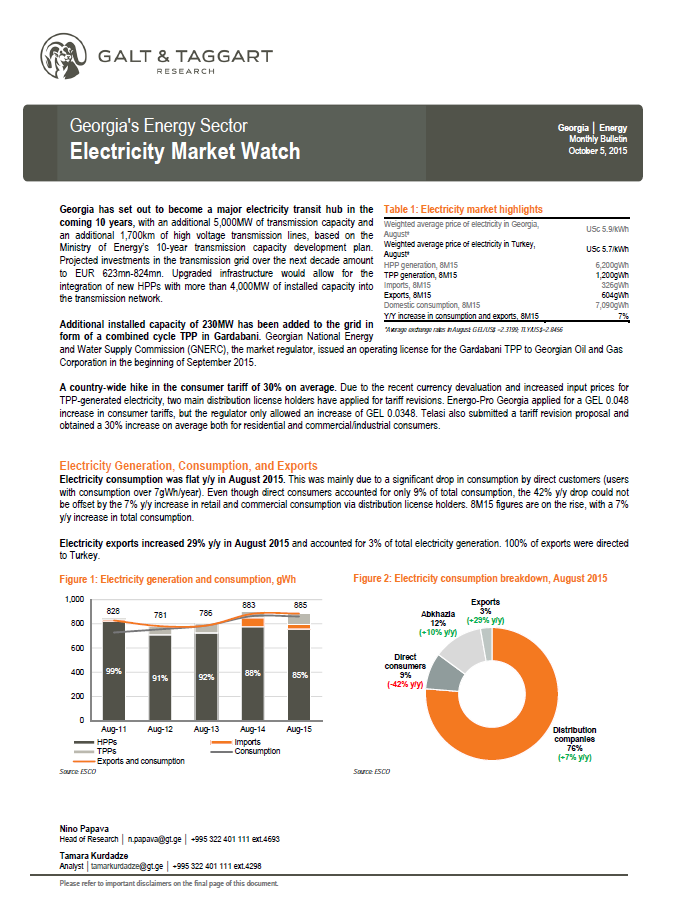

Electricity consumption was flat y/y in August 2015. This was mainly due to a significant drop in consumption by direct customers (users with consumption over 7gWh/year). Even though direct consumers accounted for only 9% of total consumption, the 42% y/y drop could not be offset by the 7% y/y increase in retail and commercial consumption via distribution license holders. 8M15 figures are on the rise, with a 7% y/y increase in total consumption.

Electricity exports increased 29% y/y in August 2015 and accounted for 3% of total electricity generation. 100% of exports were directed to Turkey.

Upward pressure on electricity prices in Georgia has subsided. Prices have been at a record high since the beginning of the year. The winter prices spiked due to the currency depreciation, which started in December, and increased the price of gas (in GEL terms) used to power the thermal power plants as well as the price of imported electricity. In the summer months, there was an increase in the price of electricity supplied by privately owned HPPs. As Abkhazia increases its consumption of cheap electricity from the conventional dams, the demand for private HPP-generated electricity will keep rising in line with the rise in domestic and foreign demand, which will in turn contribute to a demand-driven rise in electricity prices. The price increase in August was almost 5% y/y.

Downward pressure on electricity prices on the Turkish market has eased, after a significant drop in prices since December 2014. Despite the temporary dip in prices on its local market, Turkey still imported a record-high amount of electricity from Georgia in 8M15 (285gWh). Electricity exports from Georgia to its electricity trade partners in 8M15 hit the highest volume since 8M11, reaching 604 gWh worth US$ 23mn in export revenue.

Energy sector was the third largest FDI recipient in 2014. National Statistics Office of Georgia (GeoStat) released the final numbers for FDI in the energy sector in 2014. The sector accounted for 11% of total FDI at US$ 190mn, down 22% y/y.