Markets:

Stocks closed out March with all three major market indexes higher than they were at the end of February, as the turmoil caused by the collapse of Silicon Valley Bank was contained, at least for now. The banking turbulence may well weigh on lending conditions in the months ahead, creating a new headwind for the U.S. economy, but the prospect of further Federal Reserve rate increases appears to have diminished. For the week, the Dow Jones jumped 3.2%, the Nasdaq rose 3.4%, and the S&P popped 3.5%.

News:

The Nasdaq 100 Index surged into a new bull market: Nasdaq 100 Index entered bull market on Wednesday (Rising more than 20% from its December low) as investors continue to pile back into tech stocks that have been shunned for much of the past year. It's an interesting turn for the market, with worries over interest rates and a looming recession, but perhaps that is what is getting cash off the sidelines. Rates will soon peak - as telegraphed by the Fed's dot plot - or easing may even ensue, while a lower growth environment can see a premium return to the old beloved tech names. Many are also nervous about missing out on the market ride-up, especially when weighing alternatives like high-yielding money market funds and inflation-linked bonds. The latest leg was powered by earnings from Micron Technology (MU), which stressed confidence in industry fundamentals, as well as broader rallies for mega caps Amazon (AMZN), Apple (AAPL) and Microsoft (MSFT). Speaking of chips and tech, Nvidia (NVDA) has exploded with an advance of more than 80% so far this year.

Alibaba to split into 6 units: On Tuesday Alibaba announced it will split its company into six business groups, each with the ability to raise outside funding and go public. Alibaba said in a statement that the move is “designed to unlock shareholder value and foster market competitiveness.” The business groups will revolve around its strategic priorities. These are the groups:

- Cloud Intelligence Group which will house the company’s cloud and artificial intelligence activities.

- Taobao Tmall Commerce Group which will cover the company’s online shopping platforms including Taobao and Tmall.

- Local Services Group will cover Alibaba’s food delivery service Ele.me as well as its mapping.

- Cainiao Smart Logistics which houses Alibaba’s logistics service.

- Global Digital Commerce Group. This unit includes Alibaba’s international e-commerce businesses including AliExpress and Lazada.

- Digital Media and Entertainment Group. The unit which includes Alibaba’s streaming and movie business.

Investors seem to be excited about this split, as shares of BABA have jumped more than 17% during the week.

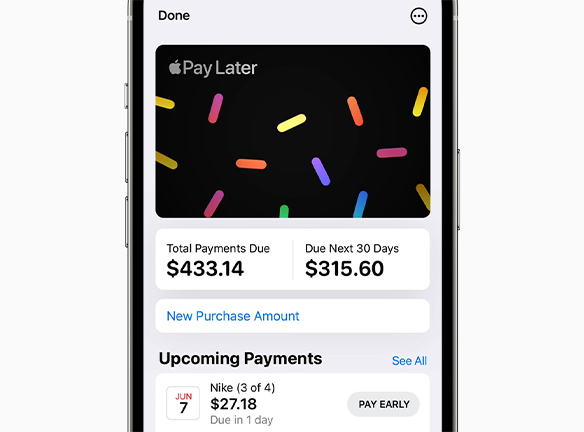

IBank: Apple (AAPL) officially released its "Buy Now, Pay Later" service in the U.S., permitting purchase payments over time with no fees and no interest. Select users can apply for Apple Pay Later loans of $50 to $1,000, which can be managed in Apple Wallet and used for both online and in-app merchants that accept Apple Pay. MasterCard (MA) and Goldman Sachs (GS) will be helping out Apple with payment credentials, while rival BNPL provider Affirm (AFRM) tumbled on the latest news.